can you owe money in penny stocks

Answer 1 of 7. You may owe money or shares which is essentially the same in practice.

How To Short Penny Stocks Like A Pro Warrior Trading

Penny stocks also dont offer as much liquidity as traditional stocks which adds to their risk.

. Make penny stocks just a fraction of your portfolio ideally 10 or less of your individual stock. Some even trade-in privately owned OTC market groups and tier 1 and 2 penny stocks even trade over major exchange markets. Penny stocks can turn a small amount of capital into a huge sum of money pretty.

Here are some of the pros of penny stocks. If youre going to buy penny stocks start small and move slowly. The short answer is.

If you invest in stocks with a cash account you will not owe your broker money even if the stocks go to zero. Yes if you engage in margin trading you can be technically in debt. Please put all your retirement savings and medical insurance premiums into penny stocks.

So if you wanted to buy a stock for 100 you could put 50 of your own money. The value of your investment. Fewer investors are willing to buy them.

Youll be rich in. Start small and diversify. Youve got to know the riskreward factor and definitely need to be.

Yes you can owe money on stocks if you buy stocks through a margin account because a margin account allows an investor to buy. Answer 1 of 5. It also makes sense to diversify your penny stock portfolio which.

No of course not. My own view it is. You can only make money in penny stocks.

Can you owe money by buying stocks. If youre dead set on giving penny stocks a try follow these tips from Brian OConnell at The Balance. The Securities and Exchange Commission.

If you acquired the stocks with your own income you will not owe your brokeragent any money if the value of the equities drops. It can be difficult to sell penny stocks. So can you owe money on stocks.

If you invest in stocks with a cash account you will not owe money if a stock goes down in value. Penny stocks have a lot of advantages. However if you buy stocks using borrowed money you will.

Margin accounts allow you to buy shares of a stock funding the purchase with up to 50 debt. Avoid penny stocks priced less than 50 cents a share. These accounts allow investors to buy stock shares worth more than what they have.

Target stocks with high. You may also owe money on stocks if you trade see on a margin account. Yes if you use leverage by borrowing money from your broker with a margin account then you can end up owing more than the stock is worth.

But there is a lot that goes into making money with these micro cap stocks. Cap your losses by limiting your holdings in the stock to no more than 1 or 2 of your overall portfolio.

How To Invest In Penny Stocks A Step By Step Guide Smartasset

10 Penny Stocks To Buy In March

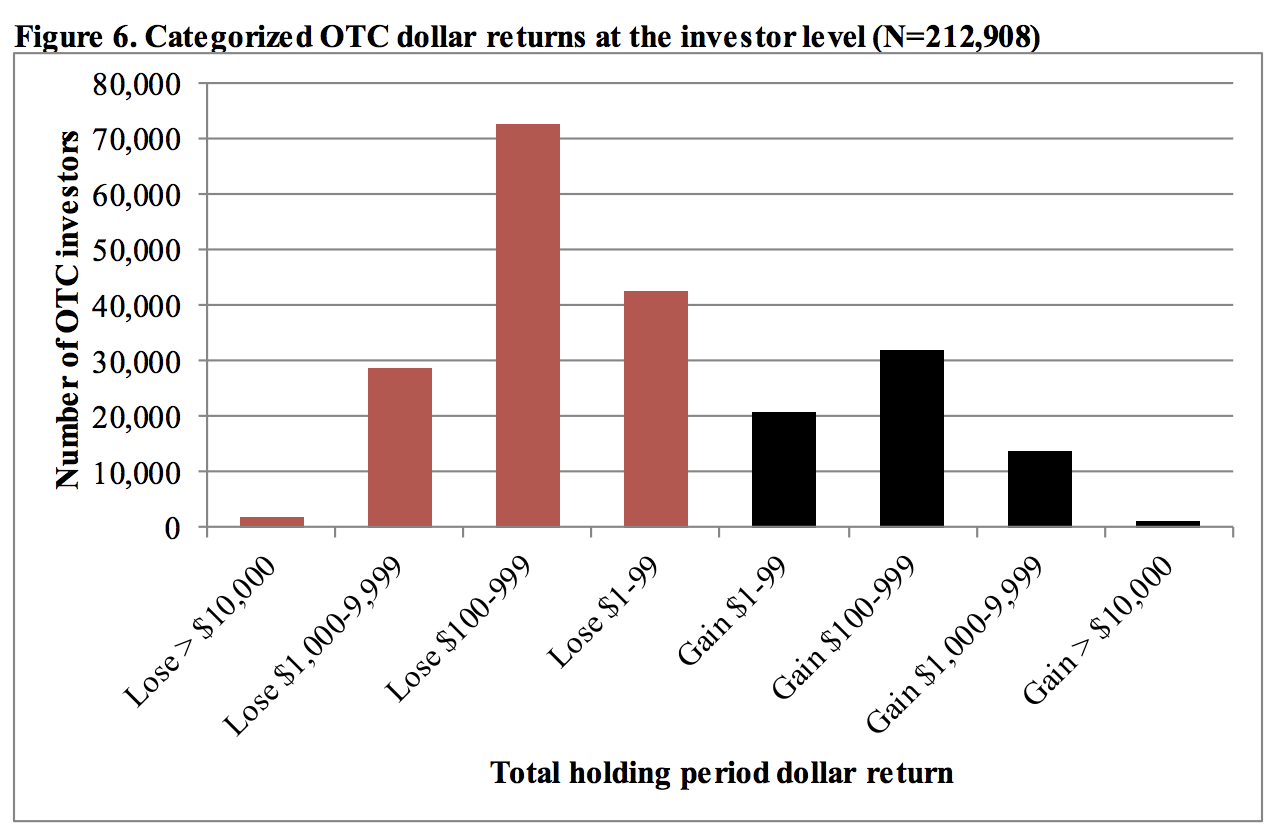

A Lot Of College Educated People Are Losing Money In Penny Stocks Seeking Alpha

10 Most Tax Friendly States For Retirees Kiplinger

5 Reasons Penny Stocks Aren T Worth The Money M1 Finance

/stock-exchange-911605_1920-aed72b97f84f4bcfa4bf7915df899781.jpg)

How Can You Lose More Money Than You Invest Shorting A Stock

How To Find Out How Much You Paid In Income Taxes On Your 1040

Owed Money But No Contract Or Agreement In Place Catalyst Law

How To Invest 10 000 Forbes Advisor

What Are Penny Stocks Experian

How To Invest In Penny Stocks A Step By Step Guide Smartasset

Here S How Stock Trading Profits Are Taxed Money

Penny Stock Patterns Explained 2022 Complete Guide

Is It Worth Investing In Only One Or Two Shares In Stocks Quora

What Are The Fundamentally Strong Penny Stocks Under Rs 10 Trading In Nse On Which One Can Bet Quora

How To Find Penny Stocks 8 Steps With Pictures Wikihow

I Started Investing This Year What Do I Need To Know Come Tax Time The Turbotax Blog

Can You Owe Money On Stocks You Ve Invested In The Motley Fool

:max_bytes(150000):strip_icc()/the-basics-of-shorting-stock-356327-v2-5bc4c22346e0fb0026b436d3.png)